By Melvin Ngayan, Regional Director - AssetWorks LLC

Every organization is exposed to a variety of risks. This includes the potential for damage from events like fires or windstorms. Preferred members contend with both of these risks making it important to be prepared. Property appraisals that provide accurate insurable values and detailed exposure data can help reduce the impact felt by a risk occurrence and increase the resilience of your operation. Let’s take a look at several strategies for how property insurance appraisals can help your organization better identify, quantify, and manage risk.

Identifying Risk

During the property insurance appraisal process, an appraisal professional collects several pieces of information about each building you intend to insure. This information helps establish a complete picture of your property profile. It includes basic building information, ISO construction classification, COPE and CAT data.

The Value of Basic Building Information

A statement of values (SOV) is a declaration to insurance providers of which properties your entity intends to insure. An updated SOV includes basic building information like building name, building address, GPS coordinates, square footage, occupancy, the year built, condition, and more.

For risk management professionals concerned about property risk exposures, an up-to-date, accurate SOV is critical. You’ll want to make sure all properties you wish to insure are reflected on your SOV and the properties you no longer wish to insure are removed; this will put you one step closer to securing the proper insurance coverage for your entity.

Why ISO and Similar Construction Classes Matter

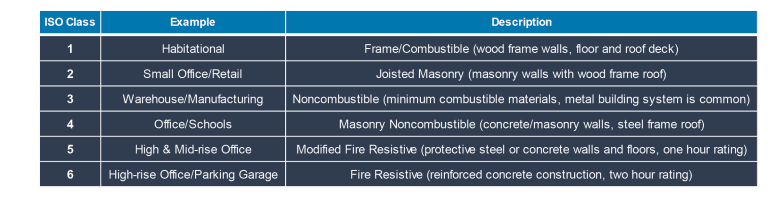

Insurance Services Office (ISO) Construction Classifications correspond with the combustibility of a building. Two important factors that determine a building’s ISO Construction Class are the material used in the construction of the building, as well as the amount of time a passive fire protection system can withstand a standard fire-resistance test.

Providing an underwriter with a building’s ISO Classification allows them to better estimate the potential for and the amount of damage that might be caused by a fire. In a building with a classification of 1 (Frame/ Combustible), a fire will spread more quickly and damage more of the building than in a building with an ISO Classification of 6 (Fire Resistive). Pair that with additional data like the distance to the nearest fire hydrant and sprinkler type, and an underwriter can get a clear picture of your fire-related exposures. Buildings which are less susceptible to damage from fire can be insured at a more favorable rate than a building which may sustain more damage.

How Collecting COPE and Secondary COPE (CAT) Data Can Help

COPE stands for construction, occupancy, protection, exposure. It includes characteristics such as the type of construction material used, number of stories, fire protection and more. Secondary COPE characteristics, or Catastrophe (CAT) modeling data, relate to the building’s susceptibility to damage from windstorms or seismic activity. Both COPE and Secondary COPE data help present the likelihood that an organization will experience losses due to a catastrophic event and quantify the potential property losses. In the absence of this data, some insurers and catastrophe modeling programs automatically assume a worst case scenario.

For example, providing underwriters with data like roof pitch, the presence of roof straps, details about windows, the presence of objects that may become missiles, and more, help these modeling programs better understand the likelihood that your building will sustain damage in the event of high winds. As with ISO Construction Class, buildings which are less susceptible to damage from windstorms or seismic events can be insured at a more favorable rate than a building which may sustain more damage.

Overall, identifying risk by establishing a complete picture of your property profile might lead to greater confidence in and understanding of your risk exposure. As a bonus, this information can be used by your organization to help better prepare for and reduce hazards.

Quantifying Risk

Having accurate, up-to-date insurable values for all buildings and structures on your Statement of Values can help ensure you are insured-to-value and covered in the event of a loss.

One of the most important considerations when quantifying risk is to insure the correct value. For example, if you simply insure the cost of constructing the building, it is likely your insurable value will be inflated. Including the non-insurable aspects associated with the construction of the building (e.g. cost to prepare the land, the foundation, underground piping) can lead to overpayment on premiums.

Most likely, you’ll want to insure-to-value using Replacement Cost New.

Replacement Cost New – The amount required to reproduce the entire property in like utility and function. It is based on current market prices for materials, labor, equipment, contractor’s overhead, profit and fees. It does not include provisions for overtime, bonuses, or premiums on materials.

A property insurance appraisal can provide the most accurate, up-to-date insurable value if it (1) is based upon each individual property and the specific attributes of that property, (2) is performed in accordance with generally accepted appraisal techniques and the Uniform Standards for Professional Appraisal practice, and (3) that incorporates various sources to develop cost conclusions for each building/structure. An appraisal provides a third-party opinion of value that is explainable, defendable, supportable and best of all, you don’t have to do it!

Accurate valuation data can help ensure you aren’t over- or under- insuring your property. By looking at this data alongside of exposure data, underwriters and insurers can truly quantify risk for your organization.

Managing Risk

Property insurance appraisals that provide detailed building information and accurate valuation data help secure the right insurance coverage for your organization. In addition, having access to detailed information about the properties on your Statement of Values can help you better manage risk.

Accurate, detailed property information supports informed decision making, provides proof-of-loss documentation, gives you more insight into your risk exposures, enables you to develop risk mitigation strategies, and can help speed up processes like insurance renewals and claims.

Here’s a look at some of the additional benefits of property insurance appraisals:

Property Insurance Appraisals through Preferred

Preferred Governmental Insurance Trust (Preferred) has contracted with AssetWorks LLC to conduct comprehensive property insurance appraisals for Preferred members. This service is being offered at no additional cost to all members who have their property insurance placed with Preferred.

The appraisal includes onsite, physical inspections of all buildings insured with Preferred. While onsite, an AssetWorks appraisal team member will collect relevant building details, including 26 data points related to windstorm exposures alone, and take photographs of the outside of the buildings.

When back in the office, the appraiser will use the data collected along with various valuation sources to determine the appropriate replacement or reproduction cost for the building. In addition, insurable land improvements outside of a building and particular to a parcel of land will be inventoried and appraised. Land improvement entries will have a full description and be listed per site. Included are assets such as fencing, outside lighting, park benches, playground structures, signage and flagpoles, boardwalks, piers, and docks.

At the conclusion of the appraisal, the following deliverables are provided:

• Certification Letter: certifies the third-party, objective opinion and valuation methodology used (e.g. in accordance with the uniform standards for professional appraisal practice) to conduct the property appraisal

• Insurance Summary Report: offers a quick snapshot of an organization’s buildings with limited building detail and valuation information

• Insurance Detail Reports: takes a deep dive into building detail including photographs and all data points collected (e.g. basic attributes, ISO construction Classifications, COPE, and CAT data)

• Value Variance Reports: provides a comparison of building values before and after the property insurance appraisal

If you have questions regarding your property appraisal, please contact your insurance agent

Mel Ngayan is a graduate of Pennsylvania State University and holds a BS in Environmental Engineering. Mr. Ngayan is a Regional Director with AssetWorks LLC and has been serving clients with onsite appraisal services since 1997. His tenure at AssetWorks LLC has included the planning, management, and execution of numerous capital asset cost accounting studies and property appraisal projects for municipalities, county governments, and other public sector entities. As a lead valuation consultant, Mr. Ngayan’s responsibilities included the training and management of appraisal staff in the Eastern Region as well as the task of managing large and complex projects.

Mr. Ngayan is Marshall & Swift Commercial Building Appraiser Certified. Mel possesses significant technical expertise in the procedures and methodologies used to value machinery & equipment, buildings & building services, infrastructure, land improvements, and land parcels. He possesses a practical knowledge and understanding of Generally Accepted Accounting Principles (GAAP); Government Accounting, Auditing, and Financial Reporting (GAAFR); Governmental Accounting Standards Board Statement 34 (GASB 34); and various other audit concerns related to capital asset reporting. Mr. Ngayan is also experienced in providing insurance replacement and proof-of-loss information to our clients to assist in addressing their insurance reporting needs. Mr. Ngayan also has significant experience appraising architecturally unique and historical buildings.